Home » Human Development and Relationships » Financial Capability Education

Financial Capability Education

Reliable and trustworthy resources to help you achieve financial well-being. Find more Wisconsin Extension Financial Resources all in one place!

Rent Smart Program

Free Rent Smart Program Now Offered in Washington County: 2021-2022 Virtual Class Schedule

Washington County Extension office offers a free program titled Rent Smart that is open to the public. For more information call 262-335-4479 or email melissa.novales@washcowisco.gov.

Rent Smart provides practical education to help people looking for rental housing to find and keep suitable housing. Rent Smart sessions cover:

- Tenant and landlord rights and responsibilities.

- Things to think about when looking for a place to live.

- How to read a lease – know what you are signing.

- How to complete a rental inspection and a check-in/check-out form.

- Strategies to get your security deposit back at the end of your lease.

Rent Smart is designed to help those individuals who have little to no rental experience and those who have had difficulty obtaining rental housing. Participants may be first time renters, as they graduate from school, or homeowners, transitioning to renting, and individuals with poor rental or credit history.

For more information on the program, visit https://fyi.extension.wisc.edu/rentsmart/

Financial Resources

Check Out Extension’s most current Financial Resources Guide!

Managing Your Personal Finances in Tough Times

Free, reliable resources to make sound financial choices in five areas:

- Talking with Family and Managing Stress

- Creating a Budget

- The Balancing Act: Cutting Expenses and Increasing Income

- Keeping Up with Credit and Debt

- Considering Foreclosure and Bankruptcy

Paying For Your Plan: Budgeting for Health Insurance

Information for those individuals and families who are learning how to adapt to financial changes with health insurance coverage.

Financial Education and Money Management Helping families achieve financial well-being – keeping pace with day-to-day expenses, reaching financial goals, planning for life’s unexpected events, and securing their financial future.

Money Matters Online Modules Learn about your financial strengths, gain new money management skills and build knowledge you can share with others–your kids, your spouse, friends, co-workers, and more.

Podcast: Drop in Income

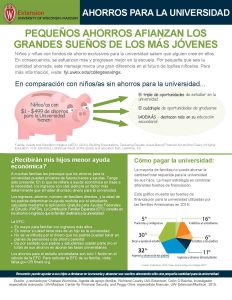

College Savings Information

Money Smart Newsletters

Credit

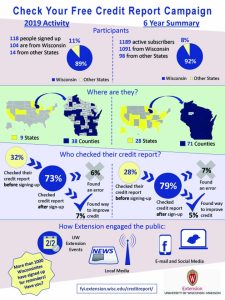

Check Your Free Credit Report Campaign: 2/2, 6/6, 10/10

By law, everybody can obtain three free credit reports each year. The information in your credit report affects your life in important ways–your ability to get a loan, how much you pay for credit and insurance, securing a job, renting a house or apartment, and preventing identity theft. It is important to check your report regularly to make sure it is accurate and up-to-date. The credit reporting system is set up so that you are responsible for finding and correcting errors–you must play the role of quality controller for the information in your reports.

To better keep track of which credit report companies you have used, the materials you reviewed and any errors on your credit reports, download and print this Check Your Credit Tracking Sheet.

We encourage you to mark your calendars on 2/2, 6/6, and 10/10 this and every year as a reminder to request a copy of your free report on those days. “2/2, 6/6, 10/10” is meant as a simple way to remember to pull your free credit reports regularly. Download a personal reminder to your calendar here.

We encourage you to mark your calendars on 2/2, 6/6, and 10/10 this and every year as a reminder to request a copy of your free report on those days. “2/2, 6/6, 10/10” is meant as a simple way to remember to pull your free credit reports regularly. Download a personal reminder to your calendar here.

Three Ways to Obtain Your Free Report

- Online: visit AnnualCreditReport.com

- Mail: send this request form to

Annual Credit Report Request Service

P.O. Box 105281

Atlanta GA 30348-5281

Requests by mail may take 2-3 weeks for delivery - Phone: (887) 322-8228

For more information, visit University of Wisconsin-Extension’s Obtain Your Free Report to learn how to obtain and read your credit report, Reading a sample credit report ![]()

Important: You never need to provide a credit card number to obtain your free credit report. Websites that ask for your credit card number may bill you for your report.

EITC Information (Tax Credits)

Low and moderate-income workers in Wisconsin may be eligible for thousands of dollars of additional income at tax time. For many families, the federal Earned Income Tax Credit (EITC), together with the state Earned Income Credit, can bring in anywhere from a few dollars to more than $8,000, depending on household income and size. Both credits specifically target employed households, and are intended to supplement earnings from work. Workers can receive the credits even if their incomes are too low to pay any income taxes.

Check out the latest Tax Credit Chart & general tax definitions flyer in both English & Spanish for information on tax credits for which you may be eligible. To help eligible households learn about the credits, UW-Extension has developed a website providing detailed information—including information on eligibility and benefits, links to tax forms, and more. The website can be found at https://fyi.extension.wisc.edu/eitc/

Online Money Matters Program

New financial education programs, now available for Washington County residents!!

Online Class with option for Financial Coaching follow up:

- Learn about your financial strengths, gain new money management skills, and build knowledge you can share with your kids, your spouse, friends, co-workers, and more with these Money Matters Online Modules

- In Washington County, Money Matters can be used as a self-study program — or — Follow up with UW-Extension Financial Coaching to earn a certificate of completion. Contact UW-Extension to learn more 262-335-4479 or carol.bralich@wisc.edu

- There is no charge for these programs

Money Smart Week

Questions or Concerns? Contact the Human Development & Relationships Staff